Bookkeeping Services: Ditch the Spreadsheet

Are you a small business owner drowning in a sea of receipts and struggling with spreadsheets? You’re not alone. Many entrepreneurs wear multiple hats, and bookkeeping often falls by the wayside. But neglecting your finances can have serious consequences, hindering your growth and causing unnecessary stress. This is where bookkeeping services come in. By partnering with a professional bookkeeping service, you can finally ditch the spreadsheet and free yourself to focus on what matters most – running and growing your business.

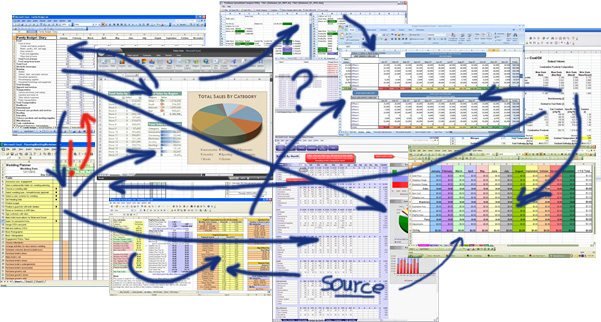

The Struggles of Spreadsheet Bookkeeping:

Spreadsheets may seem like a simple solution at first, but they quickly become cumbersome and error prone as your business scales. Here’s why spreadsheets are a bookkeeping headache:

Time-consuming:

Manually entering data, categorizing transactions, and reconciling accounts takes away valuable time you could be spending on strategic initiatives.

Prone to Errors:

One small mistake can snowball into significant financial inaccuracies, leading to bad decision-making.

Limited Functionality

Spreadsheets lack the features of dedicated bookkeeping software, making it difficult to generate reports, track inventory, and manage payroll.

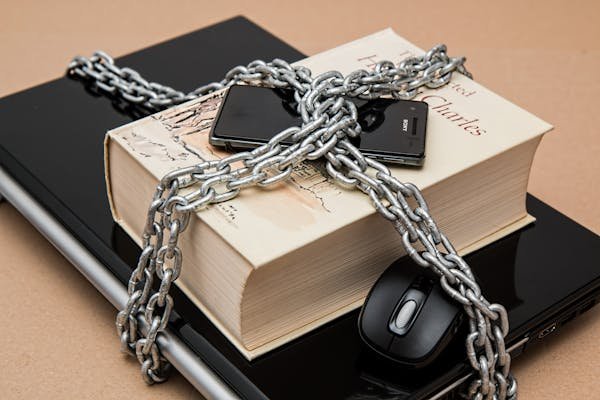

Security Concerns:

Spreadsheets aren’t designed for secure data storage, leaving your financial information vulnerable.

Benefits of Professional Bookkeeping Services:

Investing in bookkeeping services offers a multitude of benefits:

Save Time and Money:

Experienced bookkeepers can streamline your financial processes, saving you valuable time and potentially reducing accounting fees down the line.

Improved Accuracy:

Professionals ensure your books are accurate and up-to-date, giving you peace of mind and reliable data for informed decision-making.

Advanced Tools and Technology:

Bookkeeping services leverage specialized software designed to automate tasks, generate reports, and provide valuable insights.

Enhanced Security:

Reputable bookkeeping services prioritize data security, protecting your sensitive financial information.

Strategic Insights:

Bookkeepers can analyze your financial data and provide actionable insights to help you optimize your business operations and achieve your financial goals.

Ditch the Spreadsheet and Embrace Growth:

By partnering with a reliable bookkeeping service, you can finally ditch the spreadsheet and regain control of your finances. With accurate data and insightful reports, you can make informed decisions, optimize your operations, and confidently scale your business.

Focus on your passion – running your business – and let professional bookkeeping services handle the rest.

FAQs

- Do I need bookkeeping services if I’m a small business? Absolutely! Even small businesses benefit from the expertise and efficiency of professional bookkeepers.

- What services do bookkeeping companies offer? Services can range from data entry and reconciliation to payroll processing, financial reporting, and tax preparation. The specific services you need will depend on your business size and complexity.

- How much do bookkeeping services cost? Costs vary depending on the services you require and the complexity of your business. However, the cost savings from improved efficiency and reduced errors often outweigh the investment.